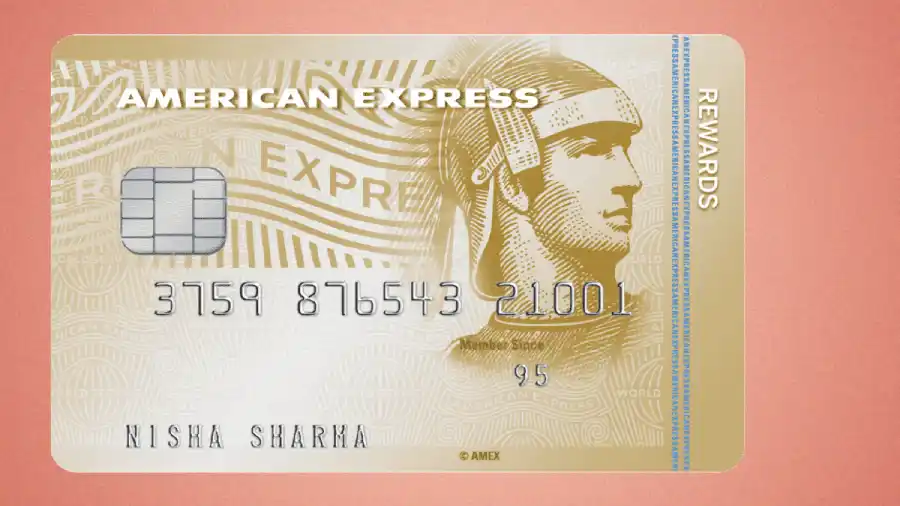

This card is in the first Ten in the list of the world’s most popular cards. But now we will know how useful this card is for the residents of India.

Join us on YouTube to watch Credit Card videos. Let’s start.

Jonning Fees and Renewal Fees

The American Express Membership Rewards Credit Card (MRCC) charges a joining fee of ₹1,000 plus applicable taxes for the first year.

You’ll receive an extra 2,000 Referral Bonus Membership Rewards points when you spend ₹5,000 within the first 90 days.

As for the renewal fee, it is ₹4,500 plus applicable taxes for the second year onwards.

- 100% Waiver: If your total spends on the American Express Credit Card in the immediately preceding membership year exceed ₹1,50,000.

- 50% Waiver: If your total spends on the American Express Credit Card in the immediately preceding membership year fall between ₹90,000 and ₹1,49,999.

PROS AND CONS

American Express (Amex) credit cards in India offer great benefits, but they might not suit everyone.

Pros:

- Reward Rates: Amex cards, like the Platinum Travel Credit Card, give high rewards, up to 8.5% on travel spending, in the form of Membership Rewards points.

- Travel Benefits: Premium Amex cards offer perks like airport lounge access, travel insurance, and priority boarding.

- Customer Service: Amex is known for good customer service, though it may vary in India.

Cons:

- Limited Acceptance: Not all merchants in India accept Amex, so you might face issues using it for everyday purchases.

- Annual Fees: Many Amex cards have significant annual fees. Ensure your spending justifies these costs.

Features and benefits of the American Express Membership Rewards Credit Card (MRCC)

features and benefits of the American Express Membership Rewards Credit Card (MRCC) in India:

Welcome Gift

Receive 4,000 Bonus Membership Rewards Points as a welcome gift when you apply for the card.

Reward Earn Rate

Earn 1 Membership Rewards Point for every ₹50 spent (excluding fuel, insurance, utilities, cash transactions, and EMI conversions at the point of sale).

Monthly Spend Milestone

Earn an additional 1,000 Membership Rewards points by spending ₹20,000 or more in a calendar month.

This benefit is enrollment-based.

Bonus Membership Rewards Points

Earn 1,000 bonus points by using your card 4 times on transactions of ₹1,500 or above in a calendar month.

Reward Redemption

Redeem your earned reward points against gift vouchers from top brands like Amazon, Flipkart, and more.

Choose from the stunning new 18 and 24 Karat Gold Collection:

24,000 MR points / 24 Karat Gold Collection (Choose any)

- Taj voucher worth ₹14,000

- Shoppers Stop voucher worth ₹10,000

- Tata Cliq voucher worth ₹9,000

- Tanishq voucher worth ₹9,000

- Amazon voucher worth ₹8,000

- Flipkart voucher worth ₹8,000

- Reliance Digital voucher worth ₹8,000

18,000 MR points / 18 Karat Gold Collection (Choose any):

- Taj voucher worth ₹9,000

- Shoppers Stop voucher worth ₹7,000

- Tata Cliq voucher worth ₹7,000

- Myntra voucher worth ₹7,000

- Amazon voucher worth ₹6,000

- Flipkart voucher worth ₹6,000

- Reliance Digital voucher worth ₹6,000

Additional Privileges

Enjoy convenience, exclusive benefits, and assistance at any hour.

Fuel Convenience Fee Waiver at HPCL.

Hidden Fees

Charges to be Aware of with the American Express Membership Rewards Credit Card (MRCC) in India

1. Cash Advance Fees

When you withdraw cash using your MRCC, you’ll be charged a fee of 3.5% of the amount withdrawn, with a minimum fee of ₹250. Avoid using your MRCC for cash advances to dodge this hefty charge.

2. Foreign Transaction Fees

Using your MRCC for international transactions, including online purchases in foreign currency, will incur a fee of 2.5% of the transaction amount.

3. Late Payment Fee

If you miss your minimum payment due date, you’ll face a late payment fee. The exact amount may vary depending on your creditworthiness.

4. Returned Payment Fee

A fee is charged for payments that are declined due to insufficient funds in your account.

Who benefits most from this card?

The American Express Membership Rewards Credit Card is best for:

- Moderate spenders who want flexibility in rewards and have a manageable annual fee.

- People who mainly shop at stores accepting American Express.

- Those who aim to earn bonus points by meeting spending goals regularly.

However, it may not suit:

- Those who don’t travel often and prefer cash back or rewards in other categories.

- People who spend heavily on excluded categories like fuel, insurance, utilities, cash transactions, and EMI conversions.

- Individuals who don’t want to pay an annual fee and might find fee-free credit cards more suitable.

Hopefully you have a clear idea of why you should and shouldn’t use this card. Stay connected with us to know more about such simple credit cards. See you in the next post. Keep reading stay informed stay tuned for Credit card updates