This card comes in two variants: one is the EazyDiner IndusInd Bank Platinum Credit Card, and the other is the EazyDiner IndusInd Bank Signature Credit Card. The signature details have already been provided, which you can read.

Now, we will discuss the Platinum version. Since it is an elite card, you already know about our premium experiences with a free card.

Let’s see if this is the suitable credit card for your dining needs.

Joinning fees and Annual fees

The good news is that the EazyDiner IndusInd Bank Platinum Credit Card does not have any joining fees or annual fees! This can be a big advantage if you’re looking for a credit card that won’t cost you anything upfront to get started.

Welcome Bonus

The EazyDiner IndusInd Bank Platinum Credit Card offers a welcome bonus of 500 EazyPoints according to IndusInd Bank’s website

Features and Benefits of EazyDiner IndusInd Bank Platinum Credit Card

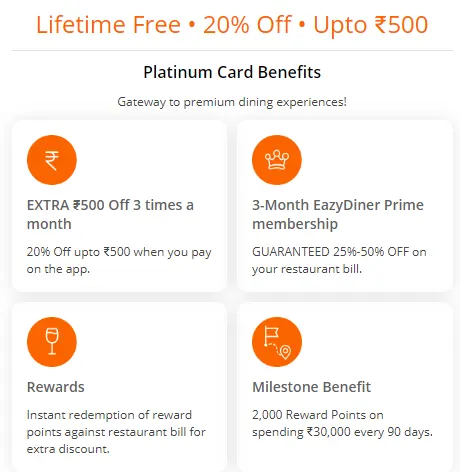

Platinum Card Benefits

- Avail EXTRA 20% OFF up to ₹500 three times a month when you eat out & pay on the app via PayEazy.

- EXTRA ₹500 Off three times a month.

- 3-Month EazyDiner Prime membership worth ₹1095.

- Enjoy GUARANTEED 25% up to 50% OFF at over 2,000+ premium bars and restaurants.

- Unlock more Prime-exclusive benefits like 2X EazyPoints and redeem them for FREE luxury hotel stays & FREE meals.

- 500 welcome bonus EazyPoints.

- Renewal of 3-month EazyDiner Prime membership worth ₹1095 upon spends of ₹30,000 every 90 days.

Rewards

Instant redemption of reward points against restaurant bill for extra discount.

Earn Reward Points

For every ₹100 spent:

1. Earn 2 Reward Points on all spends except Fuel, Insurance, Rent, Utility and Government spends.

2. Earn 0.7 Reward Points on Insurance, Rent, Utility and Government spends.

3. Pay with Reward Points: Instant redemption of reward points against restaurant bill for extra discount.

4. Earn EazyPoints: Earn 2X EazyPoints every time you complete a booking on EazyDiner.

5. Joining Bonus of 500 EazyPoints with EazyDiner Prime.

Milestone Benefit:

2,000 Reward Points on spending ₹30,000 every 90 days.

Freedom from Fuel Surcharge:

Fuel surcharge reversal of 1% of transaction value, for transactions between ₹400 and ₹4,000.

Note: Dining spends would not be considered for milestone spends.

Comparison table between HDFC Bank Diners Club Privilege Credit Card and EazyDiner IndusInd Bank Platinum Credit Card

[table id=1 /]

How to apply for EazyDiner IndusInd Bank Platinum Credit Card?

To apply for the EazyDiner IndusInd Bank Platinum Credit Card, you can follow these simple steps:

- Visit the EazyDiner IndusInd Bank Credit Card section on the IndusInd Bank website.

- Once you’ve decided to proceed with the EazyDiner card, click on the “Apply Now” button specific to this credit card.

- Fill in the online application form with accurate details.

- Submit the required documents as specified by the bank.

Hidden fees of EazyDiner IndusInd Bank Platinum Credit Card

- Finance Charges: The applicable finance charges on this credit card are 3.83% per month.

- Foreign Currency Markup Fee: When you use the card for transactions in foreign currency, a markup fee of 3.5% of the transaction amount applies.

- Cash Advance Fee: If you withdraw cash using the EazyDiner IndusInd Bank Card, the cash advance fee is 2.5% of the amount withdrawn, with a minimum of Rs. 300.

Who benefits most from this card?

The EazyDiner IndusInd Bank Platinum Credit Card can be more beneficial for individuals who frequently dine out and are looking for a credit card with no joining or annual fees.

The card offers various dining-related perks such as discounts on dining bills, EazyDiner Prime membership, welcome bonus EazyPoints, and rewards on dining spends.

Additionally, there are benefits like fuel surcharge reversal and milestone rewards.

Therefore, people who enjoy dining out regularly and want to save on their expenses can derive significant value from this card.